Southern Hemisphere Mining Limited (ASX: SUH, FWB: NK4) reports a substantial JORC mineral resource upgrade for its wholly owned Los Pumas Manganese Project in Chile to 30.26 million tonnes of ore, including 23.3 million tonnes in the indicated category.

This now concludes the exploration stage of this long-life battery metal manganese project and moves it to the scoping and metallurgical study phase.

This advance marks a major milestone in our plans to provide high-quality resources for the production of High-Purity Manganese at site in Northern Chile to supply the North American and European Union Electric Vehicle (“EV”) markets.

HIGHLIGHTS (Full PDF of ASX Release – Full JORC MRE Estimate PDF)

- 27.5% increase in the JORC Mineral Ore Resource at the 100% owned Los Pumas Battery Metal Manganese Project in Northern Chile to 30.26 Million Tonnes of Ore.

- Independent consultants, Global Commodity Solutions, estimated the Resource for the Los Pumas Manganese Project. The updated Mineral Resource has been estimated in accordance with the guidelines set in the 2012 JORC.

- Further upside is evident for exploration of Manganese feeder zones within the orebody which outcrop at surface and have had little or no prior exploration.

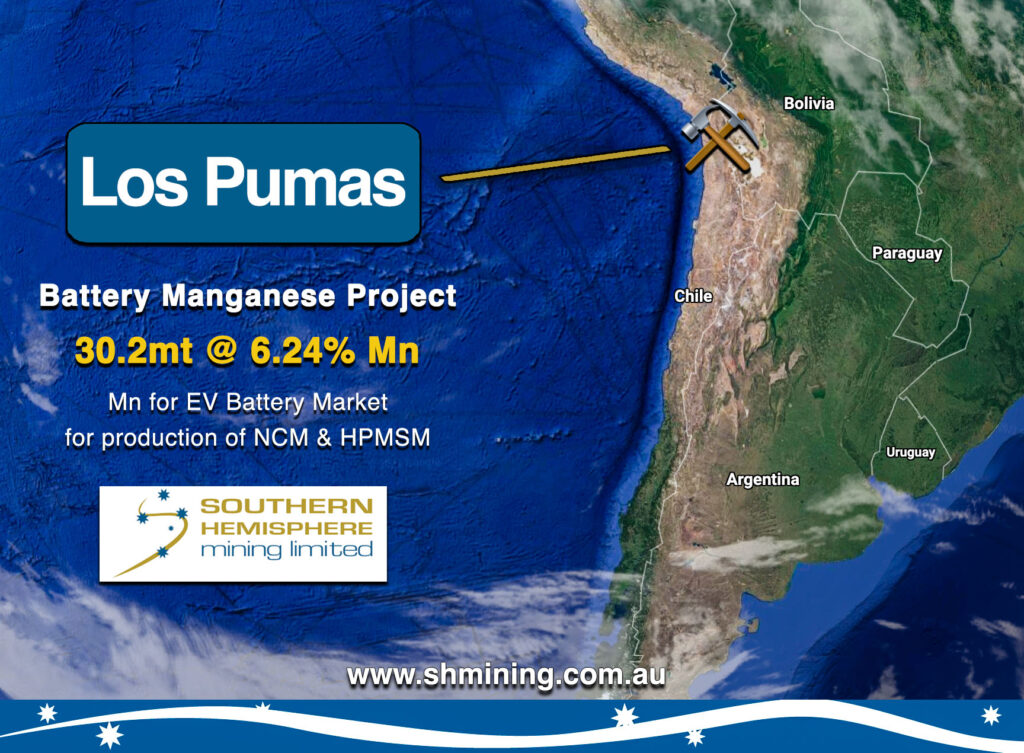

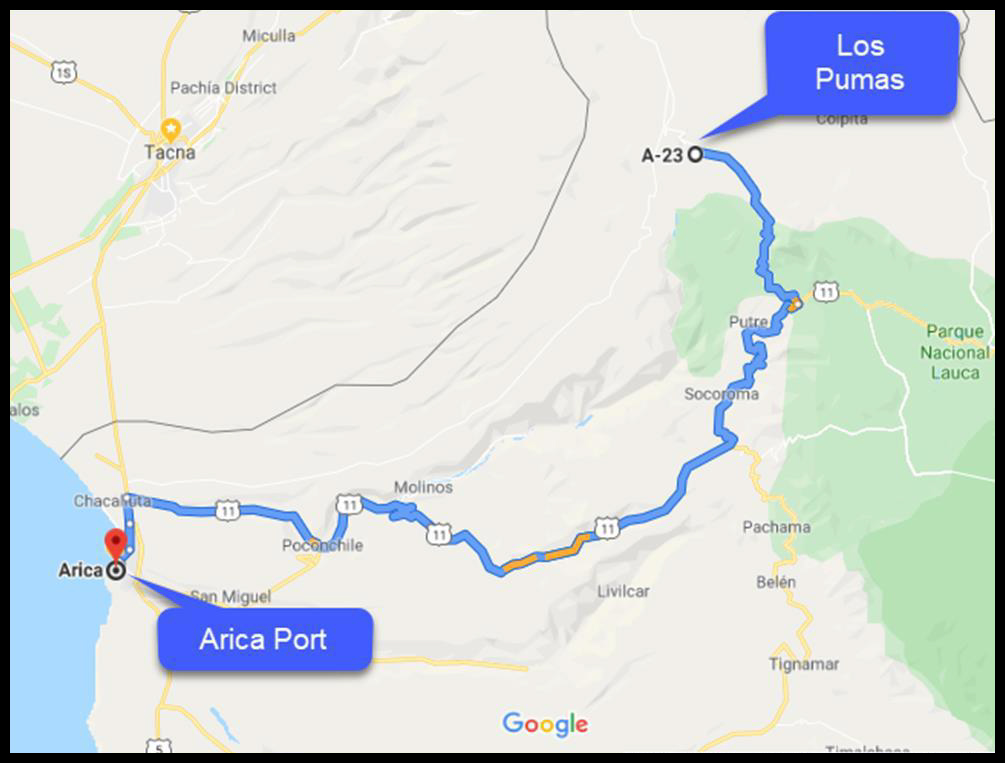

- The location of the Los Pumas Manganese Project is highly advantageous from a carbon footprint perspective, close to the Chapiquina Hydroelectric Power Plant and the port city of Arica in Northern Chile.

- This JORC Resource advances the studies towards production of High Purity Manganese Sulphate Monohydrate (“HPMSM”) at site to supply the North American, European Union and global EV markets.

Table 1: Independent Resource Consultant, Global Commodity Solutions (“GCS”) completed the JORC resource summary.

Los Pumas Battery Metal Manganese Project – 100%

Figure 1. The location of the Los Pumas Manganese Project consisting of 7 granted exploitation concessions covering an area of 1,209ha

The Los Pumas Battery Metal Manganese Project is located in Northern Chile, approximately 175km or 3 hours drive NE of Arica, the major port city in the region XV of Chile. Access from Arica to the Los Pumas Project is via the International Highway from Arica to La Paz to the regional administrative centre of Putre, then via the A23, and then a well-maintained gravel road into the project area.

Overview

The following subsections are provided consistent with ASX Listing Rule 5.8.1, with further information provided in the JORC Code (2012) – Table 1, which is attached to this announcement.

The Mineral Resource Estimate (“MRE”) was completed by Mr Kerry Griffin of Global Commodity Solutions (“GCS”) utilising the current status of drilling.

The scope of work included:

- The importation and validation of all drill hole data including collar, survey, geological, structural mineralisation, oxidation and assay information, including any processing of new assay data.

- The interpretation and solid modelling of main structural features and the interpretation and surface and/or solid modelling of main mineralisation units.

- Statistical analysis – composite length, grade distributions, top-cuts and continuity analysis – variography (if applicable) for all mineralisation domains.

- Block model creation, estimation parameter optimisation (KNA), coding and attribute assignment, grade estimation and block model depletion, validation and classification.

- A memo outlining methods and results are included in the JORC Table 1 attached to this announcement.

The Company supplied GCS with validated drill hole data, topographic surface, density data, geological mapping data and all previous reports.

Geology and Geological Interpretation

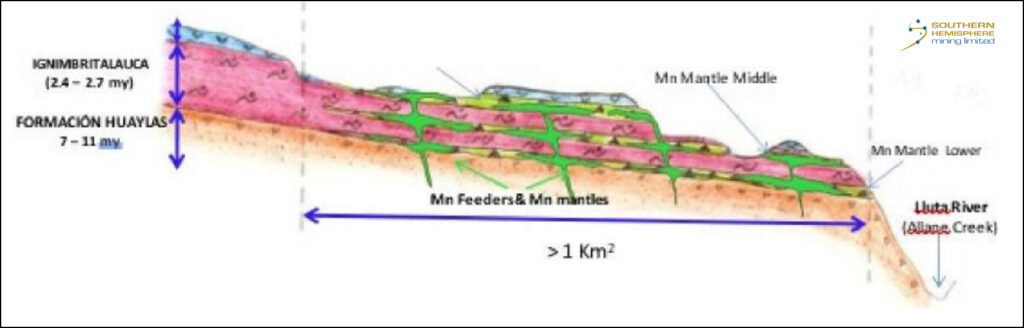

The geology of the Los Pumas Project is dominated by volcanic rocks of the Huaylas Formation (Upper Miocene age) and the Lauca Ignimbrite (Upper Pliocene). These have been subsequently overlain by Pleistocene pyroclastics, andesites and dacites and sedimentary units including primarily pumice, ignimbrites and a mixture of acid volcanic rocks (dacites and rhyodacites).

Six major volcanic centres are clearly visible from the Los Pumas Project with the closest being approximately 4km to the East.

Figure 2. Previously overlooked manganese feeder zones outcropping at surface that would be the focus of future diamond drilling for early years production drilling in the Pre-Feasibility Stage

The manganese mineralisation at Los Pumas is divided into the north and south targets and is separated by the Taapaca volcanic dacitic-andesitic flow. The north target is approximately 1.7km by 0.6km in area and with multiple mineralised zones having approximately 1m to 10m in thickness, while the south target is 1km by 0.2km in area and has similar multiple zones and thicknesses.

Mineralisation outcrops from surface in most cases, extending up to a maximum depth of 50m below surface.

Metallurgical studies have demonstrated greater than 38% Mn concentrates are achievable by DMS with low impurities and high silica product.

Sampling and Sub-Sampling Techniques

The Company’s drill hole database was supplied in Excel and CSV format. These files were imported into an MS Access database created by GCS.

GCS reviewed the input data including locating and authenticating drill holes to be used in the Resource Estimation. The reviewed data included the collar positions, assay and lithology tables and density readings. No significant errors were identified by GCS.

At Los Pumas, all drill hole positions are recorded in the WGS84 Zone 19J grid system, including the historical holes.

A total of 519 drill holes have been used in this MRE with a total of 14,855m. Within this dataset there are 32 diamond drill holes for 652m and 487 reverse circulation drill holes for 14,203m.

The topography has been acquired via a traditional topographic survey. This data was edited and merged with the surrounding SRTM data to increase coverage. The topographic surface was processed with Leapfrog and exported to Surpac format.

GCS conducted a high-level validation of the provided drill hole data only with reliance on Coffey Mining’s report for database validation.

Most sampling has been completed on 1m intervals, with some minor variation. Bulk density measurements were taken from core via the Archimedes method. The original dataset generated in 2011 required additional data as recommended by Coffee Mining and in 2022 the Company completed a further 352 SG measurements.

Core recovery within the Company’s drilling has not been calculated as the data does not contain quantified recoveries.

The wireframes used in the MRE have been created by utilising the RBF modelling tools within Leapfrog on composites 2% Mn and above, which were then exported and refined in Surpac.

QAQC

The QAQC review was completed by Coffey Consultoria e Servicios Ltda Brazil (“Coffee Mining”) for the previous resource estimate in 2011. There has been no additional drilling since then so the QAQC review remains valid for this MRE. A summary of the QAQC information is contained in Section 1 of Table 1 attached to this announcement.

Sampling Analysis Method

For the drill hole sample assays, manganese analytical results below the limit of detection have been reported as a zero or 0.01. Missing values have been coded -1 within the assay table, which is subsequently ignored during compositing.

The drill hole data has been sample composited downhole prior to the geostatistical analysis, continuity modelling and grade estimation process to 1m in order to fit within the relatively flat and thin model domains.

The compositing has been run within the wireframes as hard boundaries with a variable sample length method, which keeps the sample intervals as close to a set to fixed with 75% of the sample accepted at the boundary.

Composites within each of the mineralised domains have been analysed to ensure that the grade distribution is indicative of a single population, with no requirement for additional sub-domaining, and to identify any extreme values which could have an undue influence on the estimation grade within the domain.

For all the manganese composites top cutting to 30% was completed.

Ordinary kriging and downhole compositing provide some limits of the effect of clustered data, it is important to gauge the impact of sample clustering at a range of cell sizes to determine if there is a potential problem.

Analysis of composites within the mineralisation wireframes shows a minor change in grade when tested against declustering at the selected block model size (12.5 x 12.5 x 2m).

The data within the Los Pumas MRE is slightly clustered around the higher grades as the declustered mean of Mn% is 5.61% as compared to the native mean of 6.01 Mn%.

Variographic analysis was undertaken on the composites for the mineralisation domain. Traditional variograms for each element has been generated in Snowden Supervisor v8.9.1 using the following approach:

- All variograms have been standardised to a sill of one.

- The nugget effect has been modelled from the true downhole variogram.

- Variograms have been modelled using two-structure nested spherical variograms.

A Kriging Neighbourhood Analysis (KNA) has been undertaken on the global manganese mineralisation in order to determine the optimal block size and estimation parameters for the block model estimation.

A range of block sizes was tested, with the 12.5m x 12.5m x 1 block size returning the best result indicating the best kriging efficiency, slope of regression and negative weights.

GCS then reviewed the number of informing samples. The kriging efficiency and slopes of regression flatten off at around 24 samples. The negative weights begin to be of influence at 26 samples, therefore the optimal number of informing samples is between 4 and 24.

Search ellipse distances have been tested at the multiples and divisions of the variogram range to determine the optimal search ellipse size.

The results indicate that from 187m x 84m x 20m and larger, there is no significant increase in the kriging efficiencies or slopes and no further decrease in negative weights. This search ellipse size has been selected based on consideration of it covering 4-5 times the drill spacing and greater than any variography range.

Estimation Methodology

The block model was created to cover all wireframe extents. The wireframes solid numbers have been used to code the model domains into the block model.

GCS has estimated the Mn, Al, Fe203, K, P and SiO2 grades using the ordinary kriging into cells using the variography for each element. Boundaries between the different wireframes were treated as hard boundaries to prevent highgrade or low-grade smearing between individual wireframes. All the blocks within the mineralised domains have been filled with three search passes. The Los Pumas Project has not been mined historically therefore the model is cut with topography only.

Validation checks were undertaken on all stages of the modelling and estimation process. Final grade estimates and models have been validated using a visual comparison of block grade estimates versus the input drill hole data, a global comparison of the average composite versus the estimated block grades and moving window averages/swathe plots comparing the mean block grades to the composites.

A visual comparison of composite sample grade and block grade has been conducted in long section, cross section and plan view. The block model, as estimated appears to reflect the composite data reasonably well.

The final grade estimates have been validated statistically against the input assay composites.

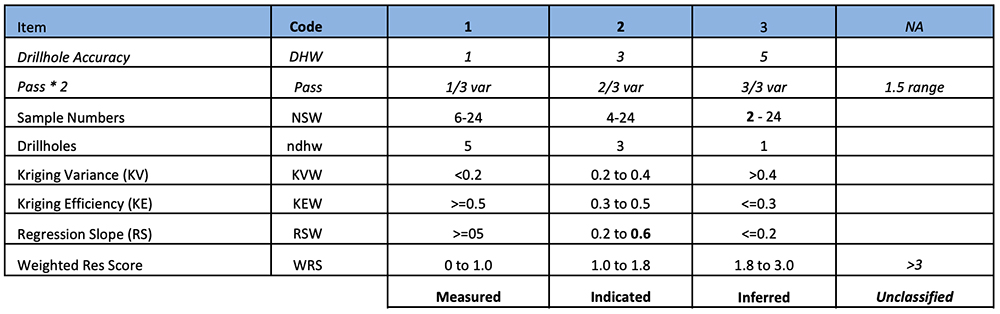

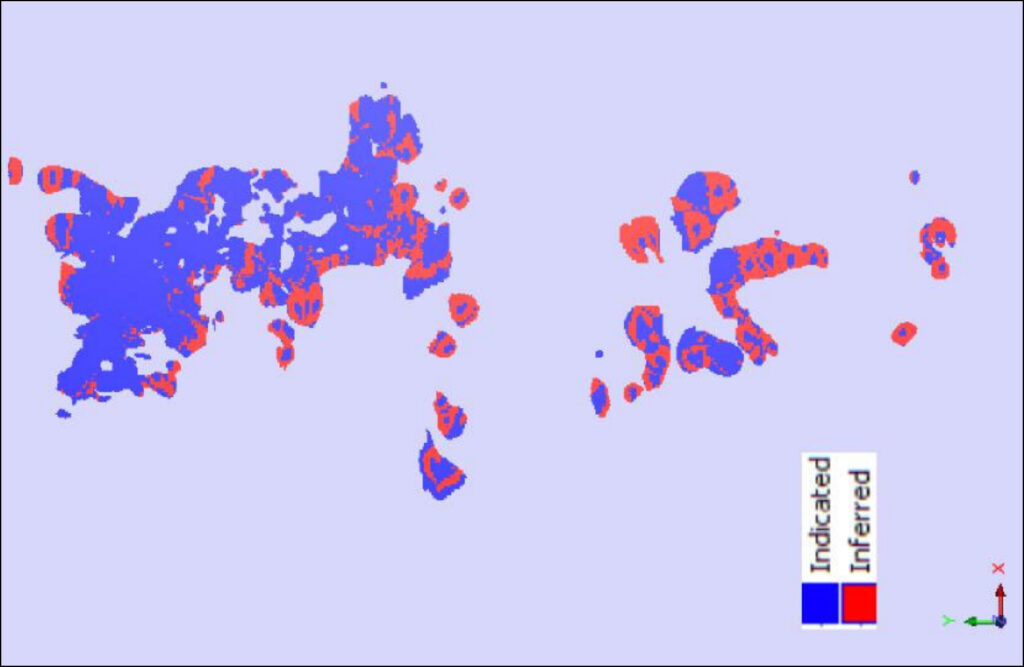

Resource Classification

Classification of the Los Pumas Manganese Project MRE has been completed in accordance with the Australasian Code for Reporting of Mineral Resources and Ore Reserves.

The resource classification approach applies weight to key parts of the estimate including, confidence in drill hole/wireframe location, number of contributing samples, the estimate pass, the number of contributing drill holes, Kriging Variance (KV), Kriging Efficiency (KE), and the Regression Slope of the estimate (RS). Good results in each get a weighting of 1, low gets a 3, with average results getting a 2. These weights are then used to assign a weighted resource categorisation score.

The numbers adopted are below:

Mineral Resource Estimate

The Company has engaged independent consultant, Global Commodity Solutions to complete a JORC 2012 compliant Mineral Resource Estimate and a review of the current status of drilling for the Los Pumas Manganese Project.

The resulting assays were modelled in Leapfrog and Surpac as an RBF model which was then used to produce an ordinary kriged estimation within Surpac. Using a cut-off grade of 2.5% manganese. This resulted in nominally indicated and inferred resources totalling 30.2mt at 6.24% Mn.

Table 1: Independent Resource Consultant, Global Commodity Solutions (“GCS”) completed the JORC resource summary.

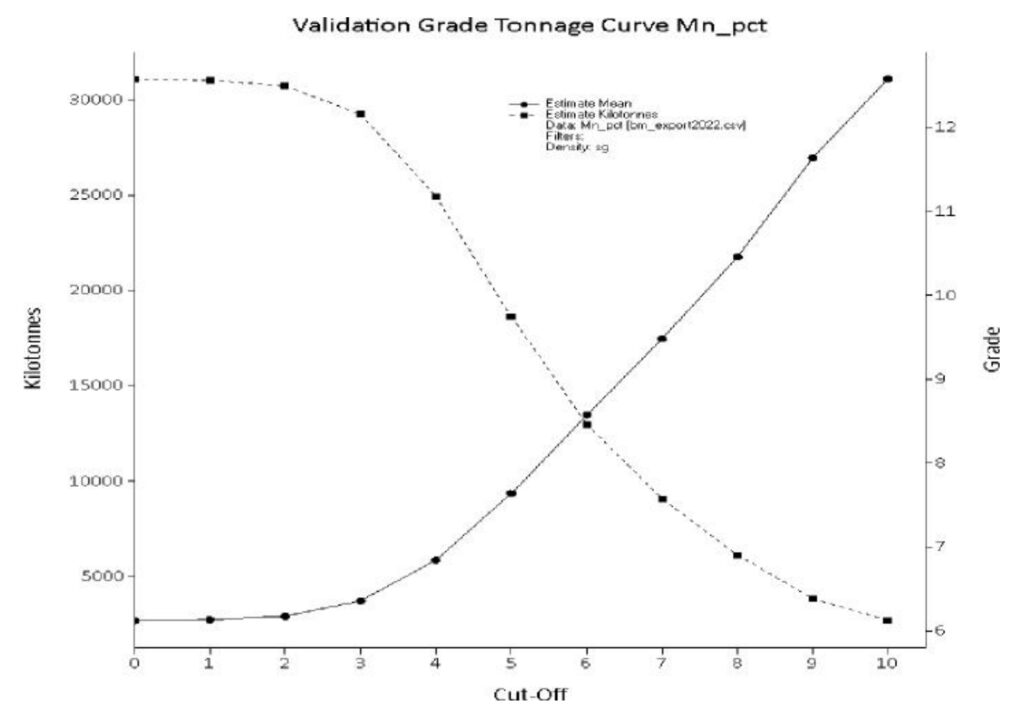

The impact of the cut-off grade on the MRE tonnes and manganese grades is provided below:

Figure 5. Grade tonnage curve for Indicated, Inferred and Unclassified JORC resources at the Los Pumas Project

Manganese on the Rise

The market for HPMSM is forecasted to grow tenfold to 2030 based on EV demand, to 3.1 million tonnes per annum and a deficit of 1.5 million tonnes (CPM Group forecast 2021). The majority (90%) of the current supply chain is produced in China and the EV manufacturers report is seeking to balance supply from a range of sources. The demand for North American high purity manganese is expected to rise to approximately 200,000 tonnes per annum metal equivalent by 2031.

The manganese ore from Los Pumas has completed the first stage leach amenability test-work with excellent results determining that the ore was suitable for HPMSM for the battery metals market. The Los Pumas ore achieved ~99% extraction of manganese under “standard” leach conditions, producing a leach solution containing 80 g/L manganese. There were also no deleterious elements that would be cause for concern in future stages.

Chile Mining Legislation

The Chilean government recently announced a review of its lithium mining laws which the Company notes as follows:

Lithium has always (since 1970’s) been a strict government-controlled mineral, and over that time there are only two operators, SQM and Albemarle. The government is seeking to vary these arrangements when the terms of the contracts expire – SQM at the end of the decade and Albemarle in 2043.

Chile has a unique royalty regime for lithium production that differs from its typical mineral royalty system. In Chile, lithium production is subject to a specific royalty rate known as the “special operation contact” or “contrato especial de operación minera” (CEOM) royalty. These royalties are up to 40%. It’s important to note that the CEOM royalty rate is only applicable to lithium production in Chile and does not apply to other minerals or metals. The royalty is paid to the Chilean government and is in addition to any taxes or fees that may be applicable to mining operations in Chile.

Chile is a well-established tier one mining jurisdiction and holds an A2 Moodys credit rating. Recent acquisitions by major copper producers in the country attest to its attributes, for example, South 32 purchase of 45% of Sierra Gorda copper mine for US$1.55bn in Nov 21, Lundin Mining’s purchase of 51% of Casserones Copper mine for US$950m in March ’23 and the recent $23bn bid for Teck by Glencore.

Further details on the advancing Los Pumas Battery Metals Project will be reported in due course.

COMPETENT PERSON / QUALIFIED PERSON STATEMENT:

The information in this announcement that relates to Mineral Resources complies with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code) and has been compiled, assessed and created by Mr Kerry Griffin BSc. (Geology), Dip Eng Geol., a Member of the Australian Institute of Geoscientists. Mr Griffin has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration, and to the activity being undertaking to qualify as a Competent Person as defined in the 2012 Edition of the JORC Code. Mr Griffin is the competent person for the resource estimation and has relied on provided information and data from the Company, including but not limited to the geological model and database.

News Release

Date: 3 May 2023 | ASX Code: SUH

===

Southern Hemisphere Mining Limited is an experienced minerals explorer in Chile, South America. Chile is the world’s leading copper producing country and one of the most prospective regions of the world for major new copper discoveries. The Company’s projects include the Llahuin Porphyry Copper-Gold-Moly Project and the Los Pumas Battery Metals Manganese Project, both of which were discovered by the Company.

Southern Hemisphere Mining Limited is an experienced minerals explorer in Chile, South America. Chile is the world’s leading copper producing country and one of the most prospective regions of the world for major new copper discoveries. The Company’s projects include the Llahuin Porphyry Copper-Gold-Moly Project and the Los Pumas Battery Metals Manganese Project, both of which were discovered by the Company.

For the latest information about the Company – please visit our Latest News and Corporate Profile pages. We are also on LinkedIn and Twitter.