Southern Hemisphere Mining Limited is poised to expand their current copper foothold in Chile as the copper price continues to surge – hitting record highs of in excess of US$10,000 per ton this week (10/05/21).

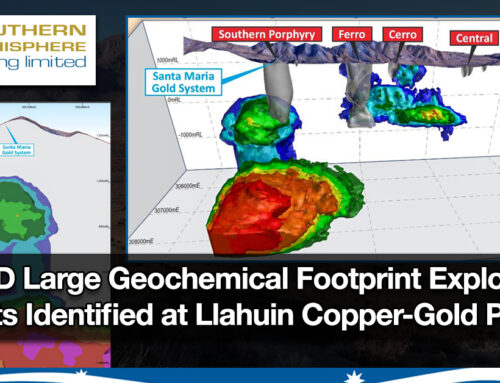

The company’s market cap currently sits at <A$10m and has a substantial copper/gold resource with 149mt @ 0.41% CuEq at its Llahuin Project in Chile and further drilling to get underway shortly.

From Bloomberg 09/05/21:

‘A year into the red-hot bull run in industrial metals that’s lifted copper to record highs, investors are still piling in, staking billions of dollars that it won’t run out of steam any time soon.

The word from Wall St. is “don’t stop buying now,” with Goldman Sachs Group Inc. and Bank of America Corp. among those advising investors to load up in anticipation of a long-term rally fuelled by the world’s recovery from the pandemic and a spending splurge on renewable-energy and electric-vehicle infrastructure.

Copper’s already doubled in the past year to more than $10,000 a ton, and Bank of America says $20,000 is possible if supply falters badly while demand surges.’

Copper Price Chart per ton courtesy of LME – May 2021

For more details on Southern Hemisphere Mining’s Projects please go here.

News Release

Date: 10 May 2021 | ASX Code: SUH

===

Southern Hemisphere Mining Limited is a successful copper-gold explorer in Chile, the world’s leading copper producing country and one of the most prospective regions of the world for major new copper discoveries.

Southern Hemisphere Mining Limited is a successful copper-gold explorer in Chile, the world’s leading copper producing country and one of the most prospective regions of the world for major new copper discoveries.

For the latest information about the Company – please visit our Latest News and Corporate Profile pages. We are also on LinkedIn and Twitter.